The simplest way to get a

Long-Term Care Plan.

Long-Term Care Planning is our specialty and all we do… since 2002.

Our process is easy, tested, and frustration-free. Right from the comfort of your own home.

No pitches.

We don’t believe in “selling” insurance. We believe in educating people about their choices so they can buy what’s right for them.

Unbiased advice.

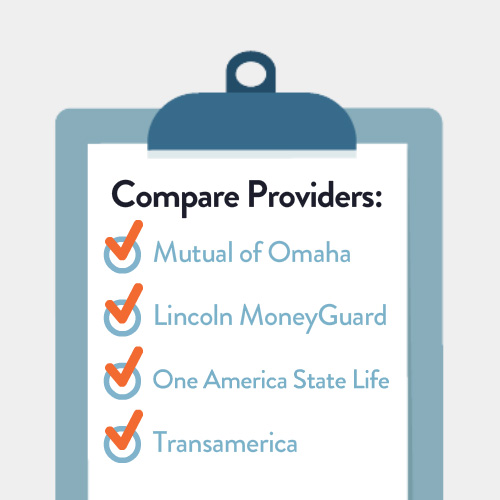

As Insurance Brokers, we are licensed with all the top insurance companies to help clients compare different policies and rates. We aren’t working for anyone but YOU, so our advice is 100% impartial & trustworthy.

Simplicity.

You don’t even need to leave the house. We talk you through the process while you’ll follow along on your home computer screen. It’s that easy.

So simple, you don’t even need to leave the house.

We know that your time is precious, and that’s why we make the process of finding the right plan easy and frustration-free. Your friendly adviser will send you a website link, you pick up the phone, click the link, and follow along as your adviser walks you through the process. You will discover what options best suit your needs as your adviser guides you every step of the way.

Frequently Asked Questions

How is AgeWell different than other insurance websites?

Most every insurance website exists to generate leads for insurance agents. In other words, you tell them you’re interested and they turn you into a “Sales Lead” for agents to call to sell you something.

Our approach is different. We know that every person who expresses an interest is not necessarily ready or able to buy something. We consult and educate first, at no charge. Then, if its right for you and you think we’re a good fit, we’ll help you get the best plan for you and your budget.

Will I understand my plan if I don’t sit down with an agent, face-to face?

We’ve been in this business a long time and there were many years when we sat down across the kitchen table from our clients to educate them about their choices and walk them through the application process. Today, through the power of technology, we have created a simpler method for you – one where you can stay in the comfort of your own home for the entire process.

We’ll walk you through each detail, every step of the way. Using screen-sharing technology, all you’ll do is click your mouse, and you’ll automatically see you adviser’s computer screen, where you will be walked through plan comparisons and options, covering every detail that would be explored in a face-to-face meeting. We find that our customers enjoy this process because it is easy, straight-forward, and a whole lot less time consuming than the old-fashioned way. We’ve thoughtfully engineered the experience to make it quick, convenient and frustration-free for you so that you can get back to enjoying your life, except now with the safety and satisfaction that your future, your assets and your family are protected.

Do I have to pass a health test to get a long-term care plan?

Not exactly. When you apply, the insurance company will conduct a personal interview with you by telephone or in-person. Most companies will also order your medical records from your doctor. What they see in your medical records, together with the results of your personal interview, determines if you will be approved for a plan.

Am I too young or too old for a long-term care plan?

You qualify for this protection with your good health, no matter your age. Mostly, people put their long-term care plan in place between ages 45 – 60 when their health is still good enough to qualify. Often, when people wait until their 60’s, they may already have too much negative medical history accumulated to qualify for a plan.

How much does a long-term care plan cost?

The typical annual premium is much less than paying for one month of long term care services out of your pocket.

What is the difference between traditional standalone long-term care insurance and hybrid long-term care life insurance?

Traditional standalone long-term care insurance works like your auto, homeowners, and health insurance. You pay your premium monthly, quarterly, semi-annually, or annually to keep your policy in force. There is no cash value. You receive the tax-free benefits to pay for your long-term care services when you file a claim. Your premium may be subject to a rate increase in the future, but only if your State permits it. Because you “pay-as-you-go,” these plans are more affordable. They offer more flexibility at claim time and waive your premium when you are receiving care. They offer appealing coverage options such as Shared Care for couples, may be certified under your State’s Partnership for Long-Term Care Program to protect your assets, and for business owners, premiums are tax deductible.

Hybrid long-term care life insurance links whole life or universal life insurance with long-term care coverage to: 1) pay for your long-term care services if you need care, or 2) pay your estate a tax-free life insurance benefit if you don’t need care, or 3) guarantee you can receive your money back if you change your mind and want to cancel your policy. These hybrids require more substantial premium to fund them up-front, either in a single one-time payment or payments for up to 10 years. (One company will allow you to pay premiums over your lifetime.) Because you essentially “pay-up-front”, your premiums can never be subject to a rate increase. Typical ways to fund these are by exchanging the cash value from an existing life insurance policy or repositioning a liquid asset such as a CD (Certificate of Deposit).

What are Long-Term Care Partnership Policies?

Practically every state in the nation has a Long-Term Care Partnership Program. It is a partnership between your state government and private insurance companies. Insurance companies voluntarily agree to participate by offering long-term care insurance policies that meet your state’s specified criteria. The state agrees to provide Medicaid (Medi-Cal in California) asset protection to people who purchase partnership-qualified policies.

Do traditional standalone long-term care insurance premiums go up?

Rates do not go up as you get older. Rates do not go up if you file a claim. Your rates are fixed at the age that you buy the policy. The only way that your rate can go up is if your State approves a rate increase on all policies for everyone who owns that policy series. If that is the case, you will have the ability at that time to either accept the rate increase or lower your benefits to maintain your original rate.

Do hybrid long-term care life insurance premiums go up?

No, never.

Why do I need a long-term care plan? I’m never going to go to a nursing home.

When it was first introduced over forty years ago, long-term care insurance was marketed as nursing home insurance. That is why often times it is still misunderstood. Today’s long-term care plans encompass a broad variety of treatment and care-giving options, such as home health care, homemaker services, adult care homes and other assisted living arrangements, in addition to nursing homes. They also contain provisions to adapt as technology changes so that they cover the care capabilities that will be available 30-40 years from now. Most people receive long-term care in settings outside of a nursing home. Today more than 70% of long-term care policyholders are using their plans to be cared for in the comfort of their own home.

What should I be prepared to discuss to begin looking into long-term care planning?

Being thorough and candid about your health history is the most important first step. The better we know this, the better we can help you. Not every company will take every medical condition. Some are better for certain conditions than others. Our years of experience and relationships with Underwriters at all of the companies allows us to guide you to the best company with the best chance for your approval.

I think I’m already covered for this, aren’t I?

Many people think (or hope) that the other insurances they have will pay for long-term care but here is the reality:

- your group health insurance or your HMO has no coverage for long-term care

- long term disability doesn’t pay for long-term care; it pays for your lost income

- Medicare doesn’t cover the day-to-day personal care assistance you need if you are unable to take care of yourself

What are the differences between Long-term care insurance and Hybrid long-term care life insurance?

There are 2 solutions…we will help you find out which is best for you.

Long-term care insurance

The purest form of long-term care protection, it provides the most bang for your buck by leveraging the greatest amount of long-term care coverage for every premium dollar you spend.

Your plan is customized for you and covers home health care, homemaker services, adult care homes and other assisted living arrangements, in addition to nursing homes.

These plans offer the most flexibility at claim time and waive your premium when you are receiving care. They feature one of the most appealing coverage options for couples—Shared Care. Only long-term care insurance may be certified under your State’s Partnership for Long-Term Care Program to protect your assets. For business owners (and in some cases for individuals) premiums are tax deductible.

Long-term care insurance works like your auto, homeowners, and health insurance. You pay your premium to keep your policy in force and receive the benefits when you file a claim. Because you “pay-as-you-go,” these plans are more affordable. Your premium may be subject to a rate increase in the future, but only if your State permits it.

Hybrid long-term care life insurance

The unique guarantees of hybrid plans address the concerns of those who question “what if I never need long-term care.” Also known as combos or linked benefits, these plans link whole life or universal life insurance with long-term care coverage to:

- Pay for your long-term care services if you need care, or

- Pay your estate a tax-free life insurance benefit if you don’t need care, or

- Guarantee your money back if you change your mind and want to cancel your policy

They cover home health care, homemaker services, adult care homes and other assisted living arrangements, in addition to nursing homes.

Hybrids require more substantial premium to fund them, either in a single one-time payment or payments for up to 10 years. (One company will allow you to pay premiums over your lifetime.) Because you essentially “pay-up-front”, your premiums can never be subject to a rate increase.

What real clients say about us…

“I give them a 10! They are knowledgeable, customer oriented, and go the extra mile.”

Grace, GEORGIA“Rose is extremely efficient, professional and very organized. She was extremely informative. I knew nothing about Long Term Health Care. Now I have confidence about the plan we selected. I have a comfort level now that I have long term health care. I already have recommended Rose to friends and family. Great experience!”

Diana, CALIFORNIA“Cathie was fantastic explaining all our options and providing pricing. We had several stops and starts along the way and she could not have been more kind and patient. She was invaluable and made sure we had everything we needed to proceed. Look no further. You need this insurance, get it done. Cathie will guide you the entire way.”

Linda & Steve, CALIFORNIA“Thank you Mary for the professionalism, personal care and interest you demonstrated to us as we worked through the process and ultimately made our decision to purchase two long-term care insurance policies from you. You made a very foreign and sometimes complicated insurance coverage understandable.”

Gary and Debby, OREGON“Rose listened well to what we wanted and helped us find a solution that fit our needs. It was convenient and informative and there was no pressure to purchase something that didn’t suit our needs.”

Anthony, CALIFORNIA“I very much appreciated how clearly and efficiently Mary explained the insurance options to me. I can’t imagine I could have received better service and assistance.”

Kathryn, OREGON“I knew it was important to have LTC. However, I did not know all of the intricacies of the coverage. Cathie spent a long time listening to me. Her generosity and willingness to simplify something that was so incomprehensible to me reflected her unselfishness and kindness.”

Carla, LOUISIANA“Rose was understanding, kind, funny, and a pleasure to deal with. It was easy and we had a pleasant experience through the whole process.”

Diane, ILLINOIS“Cathie is very helpful, kind, and competent. She is great at her job! This has all been done in a way that maximizes convenience for me. I appreciate that. Everything was handled well; things that were supposed to happen, did; I never felt pressured.”

Steve, MISSOURI“Mary Osborn has been exemplary in reference to our purchasing long-term care insurance. Of all the agents we consulted we found Mary to be the most knowledgeable about her product, punctual in returning our calls when we had additional questions, and attentive to issues regarding our renewals.”

Wayne and Trudy, WASHINGTON“Rose was prompt, courteous, extremely knowledgeable and a pleasure to work with.

Our questions were answered thoroughly and extra information and quotes were provided promptly when requested.

I have referred two people to Rose Clayton because of how helpful she was to us.”

Denita, TENNESSEE“Mary Osborn has made the decision making process easy for us with easy-to-understand counseling and explanations. Her professionalism and personable approach really made this entire process painless.”

Cindy, OREGON“Rose was great. She took the time to answer all my questions. She is very professional and knowledgeable about this. Very enthusiastic. Knew how to answer all questions and was able to demonstrate numerous payouts and scenarios.

I am a nurse practitioner who takes care of elders and when they ask, I would definitely recommend LTC insurance and refer them to Rose if their families are interested in discussing planning for themselves in their future.”

John, TEXAS“Mary Osborn provided excellent support and service when we were looking at long-term care insurance. Our application took some unexpected twists and turns, yet she stayed with it and helped steer us to a successful conclusion. I highly recommend her.”

Kent, OREGON“I love the convenience of doing it at home on the computer. Cathie made it so easy to do and understand.”

Mary Jo, OHIO

“ There are a lot of people who can give you a quote for long-term care insurance.

And then there are a handful of people like Rose and Cathie, who will take the time to walk you through one of the most important financial decisions you may ever make — and devote the same care and consideration when you need to file a claim.

You pick. ”

Let’s get started!

Call us now at (888) 243-1770 and one of our advisers will be in touch with you very shortly